The Greatest Guide To Custom Private Equity Asset Managers

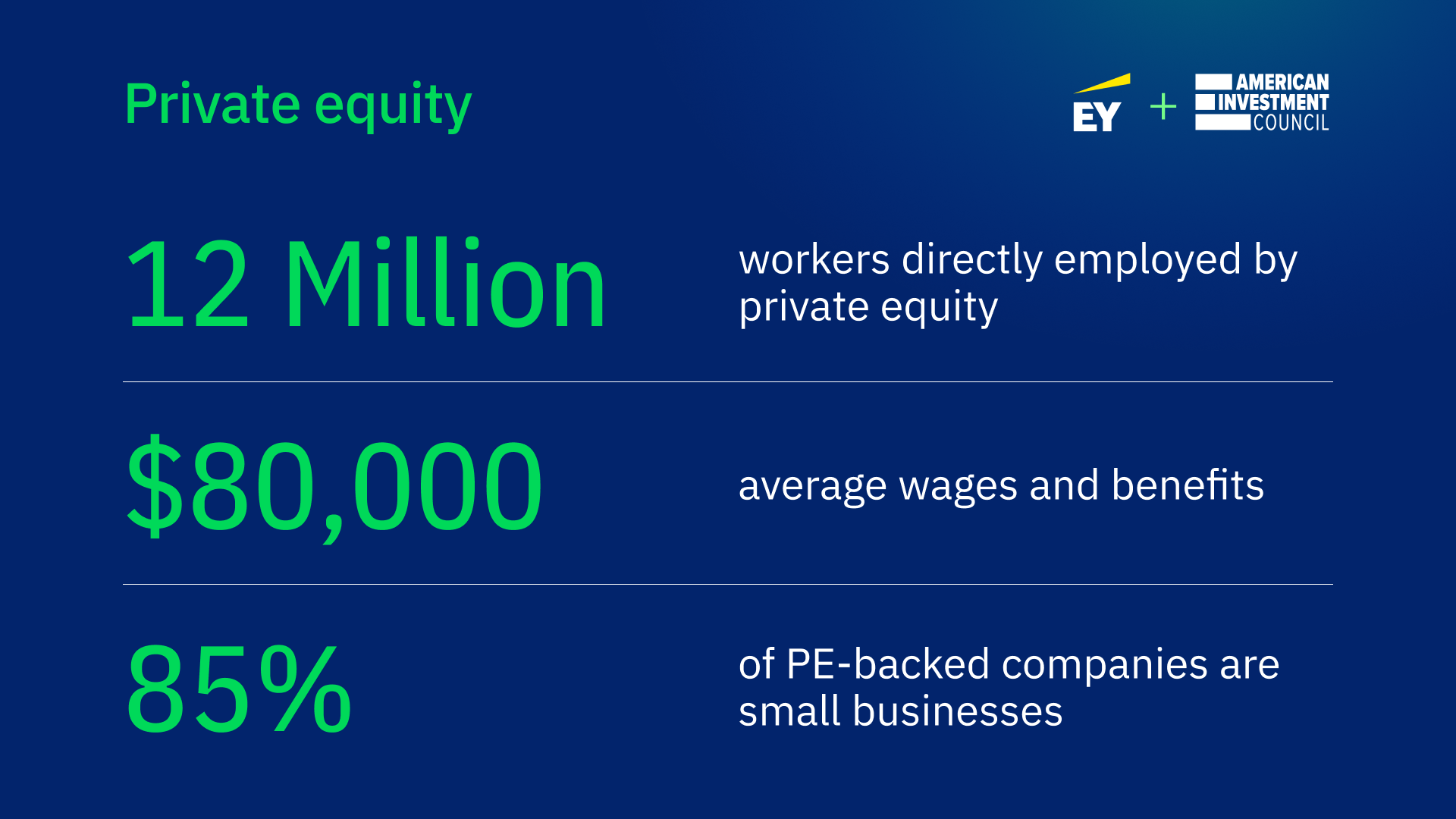

(PE): spending in business that are not openly traded. Approximately $11 (https://tx-abilene.cataloxy.us/firms/customprivateequity.com.htm). There might be a few points you don't comprehend about the sector.

Personal equity companies have a range of financial investment choices.

Due to the fact that the very best gravitate toward the larger offers, the center market is a considerably underserved market. There are much more vendors than there are very skilled and well-positioned finance experts with comprehensive customer networks and sources to handle a deal. The returns of personal equity are generally seen after a few years.

Some Known Factual Statements About Custom Private Equity Asset Managers

Flying listed below the radar of large international companies, a number of these tiny firms often offer higher-quality customer support and/or specific niche services and products that are not being offered by the huge empires (https://parkbench.com/directory/custom-private-equity-asset-managers). Such benefits attract the passion of exclusive equity firms, as they possess the insights and savvy to manipulate such possibilities and take the firm to the following level

Private equity financiers must have reputable, qualified, and reliable administration in position. The majority of supervisors at portfolio business are offered equity and incentive compensation structures that award them for hitting their financial targets. Such alignment of objectives is generally needed prior to a deal obtains done. Exclusive equity chances are typically out of reach for people that can't invest millions of dollars, yet they should not be.

There are laws, such as restrictions on the accumulation amount of cash and on the variety of non-accredited financiers. The exclusive equity service attracts some of the very best and brightest in company America, including top entertainers discover here from Lot of money 500 firms and elite management consulting firms. Law practice can additionally be recruiting premises for private equity works with, as bookkeeping and legal abilities are necessary to total deals, and deals are extremely demanded. https://pubhtml5.com/homepage/mzmjd/.

The Only Guide to Custom Private Equity Asset Managers

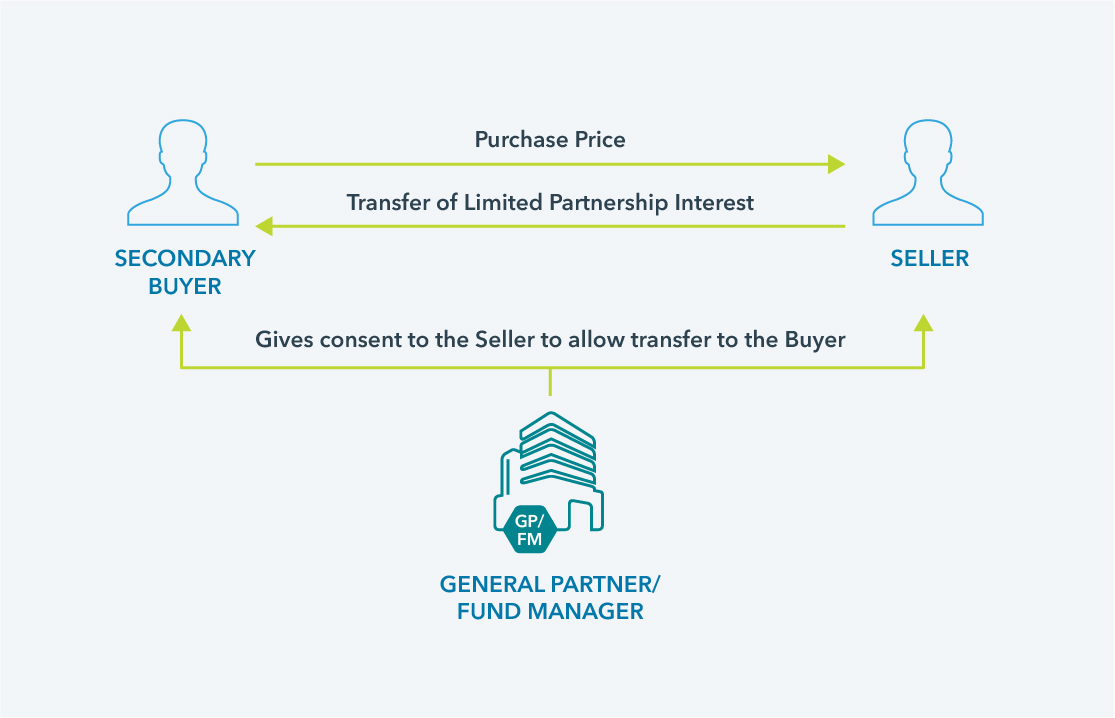

Another negative aspect is the lack of liquidity; when in a private equity purchase, it is not simple to leave or offer. There is a lack of versatility. Private equity additionally features high costs. With funds under monitoring already in the trillions, private equity companies have actually come to be attractive investment cars for well-off individuals and organizations.

Currently that access to private equity is opening up to more private capitalists, the untapped potential is becoming a reality. We'll start with the major arguments for spending in private equity: Just how and why exclusive equity returns have actually traditionally been higher than other possessions on a number of levels, How including private equity in a profile influences the risk-return account, by assisting to expand versus market and intermittent risk, Then, we will outline some essential factors to consider and dangers for exclusive equity financiers.

When it involves introducing a brand-new possession into a portfolio, one of the most basic consideration is the risk-return profile of that asset. Historically, private equity has displayed returns similar to that of Emerging Market Equities and more than all other conventional property classes. Its relatively reduced volatility coupled with its high returns creates an engaging risk-return account.

Top Guidelines Of Custom Private Equity Asset Managers

Exclusive equity fund quartiles have the widest range of returns across all different possession courses - as you can see below. Technique: Interior price of return (IRR) spreads calculated for funds within vintage years individually and then averaged out. Median IRR was computed bytaking the average of the typical IRR for funds within each vintage year.

The takeaway is that fund choice is vital. At Moonfare, we perform a stringent selection and due diligence procedure for all funds noted on the platform. The impact of adding personal equity into a profile is - as constantly - depending on the portfolio itself. A Pantheon research study from 2015 recommended that including personal equity in a profile of pure public equity can open 3.

On the other hand, the most effective personal equity firms have accessibility to an also larger swimming pool of unknown possibilities that do not encounter the same analysis, as well as the resources to execute due diligence on them and identify which deserve purchasing (Private Equity Firm in Texas). Investing at the very beginning implies greater danger, but also for the companies that do be successful, the fund take advantage of higher returns

The Buzz on Custom Private Equity Asset Managers

Both public and private equity fund managers dedicate to investing a portion of the fund yet there continues to be a well-trodden concern with lining up passions for public equity fund administration: the 'principal-agent issue'. When a financier (the 'primary') employs a public fund supervisor to take control of their capital (as an 'representative') they hand over control to the supervisor while retaining ownership of the properties.

When it comes to personal equity, the General Companion does not just gain a management fee. They also earn a percentage of the fund's profits in the kind of "lug" (generally 20%). This guarantees that the interests of the supervisor are aligned with those of the financiers. Exclusive equity funds additionally reduce an additional type of principal-agent trouble.

A public equity capitalist ultimately desires one point - for the administration to boost the stock cost and/or pay dividends. The investor has little to no control over the choice. We showed over the amount of exclusive equity techniques - specifically bulk buyouts - take control of the operating of the firm, making certain that the long-term value of the firm comes first, rising the return on financial investment over the life of the fund.